New York City Mayor Zohran Mamdani is the fresh face of America’s progressive vanguard, so his policy moves are worth watching. His first big move is threatening to raise property taxes unless Democrats in Albany raise taxes on top earners and business. What an ultimatum: Fleece the rich for him, or he’ll fleece them and the middle class.

Mr. Mamdani on Tuesday unveiled his inaugural $127 billion budget, which he amusingly called austere. Only in New York, kids. His budget is $10 billion bigger than Florida’s, though New York City’s population is only 40% of the Sunshine State’s. It’s a $10 billion increase over this year.

All Access.

One Subscription.

Get 360° coverage—from daily headlines

to 100 year archives.

Full Access to

HT App & Website

Already subscribed? Login

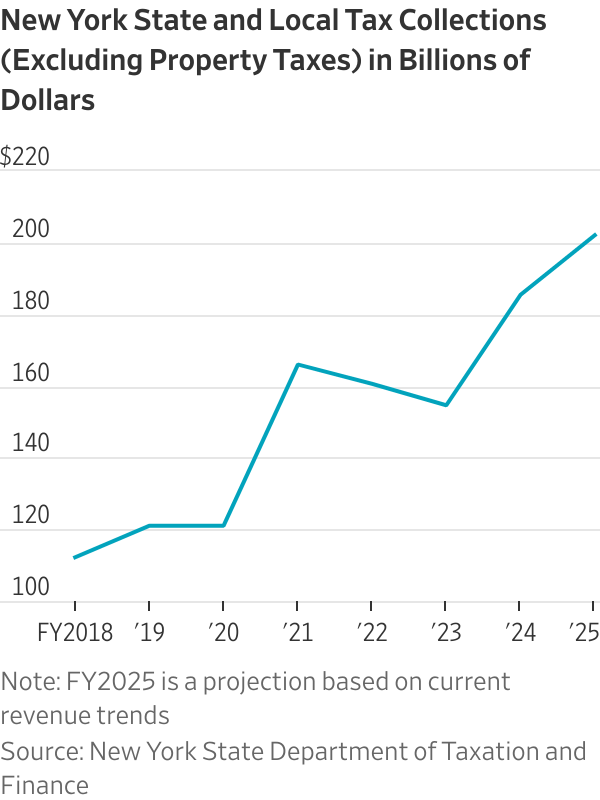

New York city and state are rolling in tax revenue thanks to hefty capital-gains realizations and Wall Street bonuses. City revenue has doubled and state tax revenue (excluding property taxes) is up two-thirds since 2019. Yet tax collections haven’t kept pace with political spending and government-worker benefits. The city faces a $5 billion shortfall, according to Mr. Mamdani.

Mind you, this shortfall is $7 billion less than the city projected a couple of months ago before a surge in income-tax collections from year-end bonuses. The top 1% of New York City earners pay nearly half of local income taxes.

Yet Mr. Mamdani wants to squeeze top earners and businesses even more to fund universal child care, free buses and other progressive dreams. On Tuesday he repeated his campaign call for Gov. Kathy Hochul and the Democrats who run Albany to raise income taxes on millionaires by two percentage points and the state corporate tax to 11.5% from 7.25%.

That would raise New York City’s corporate tax to more than 20%, roughly double the highest state rate in the country (New Jersey, 11.5%). The combined state-and-city top marginal individual tax rate would rise to 16.8% for households making more than $25 million. Individuals earning more than $1 million would pay a top rate of 15.5%, more than 50% including federal tax.

New Yorkers have been riding a Willy Wonka elevator to the sky since the financial panic when Democrats in Albany raised the combined top rate to 12.8% from 10.5%. Former Gov. Andrew Cuomo extended the state’s supposedly temporary millionaire tax again and again. In 2021 the state added three new top brackets and raised the top rate to 14.8%.

But Mr. Mamdani isn’t satisfied. “I believe the wealthiest individuals and most profitable corporations should contribute a little more so that everyone can live lives of dignity,” he said.

If he really cares about the latter, he wouldn’t bar tenants in the city’s dilapidated public housing from airing complaints at his hearings on “rental ripoffs,” as the New York Post reported this week.

Ms. Hochul has been cool to Mr. Mamdani’s tax pitch, no doubt recognizing it would prompt more to leave and possibly result in less revenue. Yet the mayor is trying to extort her by threatening to raise city property taxes by 9.5%, which he can do without state legislation.

This would smack middle-class homeowners in the outer boroughs as well as the wealthy in Manhattan. It would also compound problems in the city’s multifamily housing market caused by state rent control. Hundreds of rent-stabilized buildings have defaulted in recent years, and many are selling at discounts upward of 60% from their purchase price.

Mr. Mamdani’s transparent goal is to raise public pressure on Albany to soak high earners. “We do not want to have to turn to such drastic measures to balance our budget,” Mr. Mamdani said of his threatened property tax hike. “But, faced with no other choice, we will be forced to.” There is another choice: Spend less. Merely holding spending flat would eliminate this year’s deficit.

Mr. Mamdani claims his city’s wealthy can afford to pay more because Republicans in Washington have given them a “windfall.” But as the Empire Center for Public Policy’s Bill Hammond notes, the effective federal tax rate for New York millionaires rose 0.8 percentage points after the 2017 tax reforms because of the state-and-local deduction cap.

Last summer’s tax bill quadrupled the SALT deduction to $40,000 and blessed a state work-around for pass-through businesses, which include some top earners. But we warned Republicans this would mitigate the impact of higher state taxes and make it politically easier for progressive states to raise them, and Mr. Mamdani is now proving the point.

Mr. Mamdani’s attempt to extort Ms. Hochul over taxes is part of a broader battle in the Democratic Party. If he prevails, expect more Democrats to imitate his class warfare and hostage-taking.