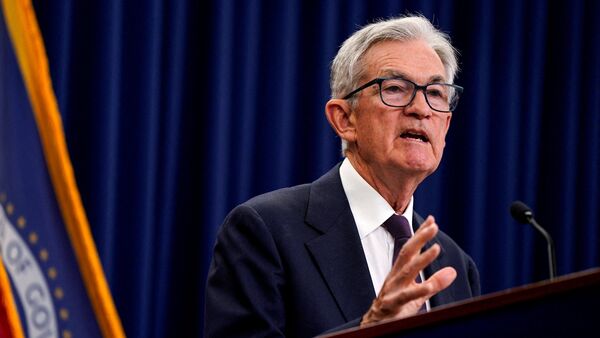

Fed Chair Powell Warns of Rising Employment Risks as Labor Market Cools

Federal Reserve Chair Jerome Powell has signaled growing concerns about the U.S. labor market, warning that “rising downside risks to employment” have shifted the central bank’s assessment of economic threats. In his final scheduled remarks before the Fed’s upcoming meeting, Powell highlighted a significant slowdown in hiring despite low unemployment rates.

Key Takeaways

- Fed Chair Powell flags rising employment risks amid cooling labor market

- Payroll gains have slowed sharply despite low unemployment

- Markets expect 95% probability of additional rate cuts this year

- Quantitative tightening process concluded, balance sheet runoff to stop

Labor Market Concerns Intensify

Powell delivered his address at the National Association for Business Economics annual meeting in Philadelphia, emphasizing that the Fed’s balance of risks has changed in recent months. “In this less dynamic and somewhat softer labor market, the downside risks to employment appear to have risen,” he stated.

The Fed Chair noted that while the unemployment rate remained low through August, “payroll gains have slowed sharply.” He attributed part of this slowdown to lower immigration and declining labor force participation, which have curbed labor force growth.

“Rising downside risks to employment have shifted our assessment of the balance of risks. There is no risk-free path for policy as we navigate the tension between our employment and inflation goals.”

Policy Outlook and Market Expectations

Powell indicated that the outlook for employment and inflation “does not appear to have changed much since our September meeting,” when the Fed cut rates for the first time this year. Futures traders currently estimate over a 95% probability that the Fed will reduce rates by another half percentage point this year, according to CME Group data.

Fed officials last month projected two more rate cuts this year and one in 2026, suggesting continued monetary policy support for the economy.

Quantitative Tightening Concludes

In a significant policy development, Powell announced that the central bank is concluding its prolonged process of reducing its holdings, commonly referred to as quantitative tightening. “Our long-stated plan is to stop balance sheet runoff when reserves are somewhat above the level we judge consistent with ample reserve conditions,” he explained.

Powell defended the Fed’s current reserve levels, stating, “We’re still at abundant reserves, meeting above our goal of ample reserves, a little bit above ample reserves.”

Data Challenges and Alternative Sources

The Fed Chair acknowledged challenges in economic data collection due to the ongoing US government shutdown. No official employment data for September has been released, but Powell noted that private sector numbers indicate a significant slowdown in hiring last month.

“Based on the data that we do have, it is fair to say that the outlook for employment and inflation does not appear to have changed much since our September meeting four weeks ago,” Powell said, emphasizing that the Federal Reserve has other data beyond government sources to inform its decisions.

The speech comes after the Fed’s September meeting where officials voted to reduce interest rates by a quarter point, aiming to bolster the struggling labor market. With gold hitting new all-time highs above $4,100 amid rate cut expectations, markets appear to be pricing in continued Fed support for the economy.