Asian Markets Rally on Trump-Xi Meeting Hopes

Asian shares surged as confirmation of a meeting between US President Donald Trump and Chinese President Xi Jinping raised hopes for progress in trade talks ahead of a critical tariff deadline.

Key Market Movements

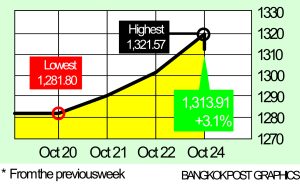

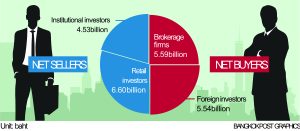

The SET index closed the week at 1,313.91 points, up 3.1% from the previous week, with daily turnover averaging 40.83 billion baht. Brokerage firms led net buying at 5.59 billion baht, closely followed by foreign investors at 5.54 billion baht.

Global Economic Developments

- The White House confirmed the Trump-Xi meeting will occur during the APEC summit in South Korea

- Gold prices fell 3.8% for the week, marking the first decline in 10 weeks

- China’s Q3 GDP grew 4.8% year-on-year, the weakest in a year but meeting expectations

- Japan’s core inflation rose to 2.9% in September, increasing pressure on the Bank of Japan

- Taiwan’s export orders surged 30.5% to a record $70.2 billion

Thailand Economic Updates

The cabinet approved stimulus measures for the 2025-2026 high season, including tax deductions and incentives. The Khon La Khrueng Plus co-payment scheme saw all 20 million slots filled on the first day, with the Bank of Thailand expecting it to drive 0.5% quarterly GDP growth.

Foreign tourist arrivals from January to October 19 fell 7.45% year-on-year to 25.65 million, though weekly arrivals showed a 6.6% improvement. Chinese arrivals remain down 29% for the year.

Stocks to Watch

Analysts recommend focusing on sectors showing lower volatility and growing investor interest:

- Banking & Insurance: KTB, KBANK, BLA

- ICT: TLI, ADVANC

- Energy: PTT, PTTEP, TOP

- Retail: CPALL

Technical Outlook

InnovestX Securities identifies support at 1,270 points and resistance at 1,335, while Daol Securities sees support at 1,289 and resistance at 1,324.

Upcoming Economic Events

- Monday: US durable goods orders

- Tuesday: US consumer confidence index

- Wednesday: Fed, Bank of Canada, and Bank of Japan rate decisions

- Thursday: Q3 GDP from Germany, euro zone, US; ECB meeting; China manufacturing PMI

- Friday: Euro zone inflation; US core PCE