Infosys Launches Record ₹18,000 Crore Share Buyback

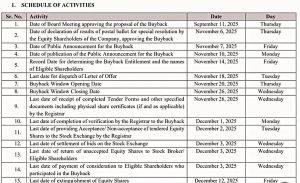

IT giant Infosys has announced its largest-ever share buyback programme worth ₹18,000 crore, set to open for subscription on November 20, 2025, and close on November 26, 2025.

Key Buyback Details

- Buyback Size: ₹18,000 crore

- Subscription Period: November 20-26, 2025

- Shares to Buy: 10 crore equity shares (2.41% of equity)

- Buyback Price: ₹1,800 per share

“The eligible shareholders can tender their equity shares during the tendering period, i.e. from November 20, 2025, to November 26, 2025.”

The company stated this buyback aligns with its capital allocation policy, balancing strategic cash needs with returning surplus funds to shareholders efficiently.

Historical Buyback Comparison

This marks Infosys’ fourth major buyback initiative:

- 2017: ₹13,000 crore at ₹1,150 per share

- 2019: ₹8,260 crore

- 2022: ₹9,300 crore at ₹1,850 per share

Promoter Participation

Notably, promoters including Nandan M Nilekani and Sudha Murty have decided not to participate in this buyback. The promoter group collectively holds 13.05% of the company’s equity.

Long-term Shareholder Value

Infosys plans to steadily increase annual dividends while using buybacks to enhance shareholder value by reducing the equity base. The company’s capital allocation policy targets returning approximately 85% of free cash flow over 5-year periods through dividends and buybacks.

“Effective from financial year 2025, the Company expects to continue its policy of returning approximately 85 per cent of the free cash flow cumulatively over a 5-year period through a combination of semi-annual dividends and/or share buyback/special dividends, subject to applicable laws and requisite approvals, if any,” according to the company’s stated Capital Allocation Policy.