Key Takeaways

- Trump’s tariff threat triggered the largest crypto liquidation in history

- Over $500 billion wiped from market in hours, 1.6 million traders affected

- Markets partially recovered after Trump softened his stance

- Analysts warn volatility could continue until trade dispute resolves

The cryptocurrency market experienced its biggest single-day liquidation in history after former President Donald Trump threatened 100% tariffs on Chinese imports, wiping half a trillion dollars in value within hours.

Bitcoin alone lost over $200 billion as Trump’s Truth Social post triggered panic selling across digital assets. More than 1.6 million traders faced liquidations according to CoinGlass data.

Trump’s Meme Coin Hit Hardest

Trump’s own meme coin plummeted nearly 40% to $4.65, a dramatic fall from its previous $45 valuation. The sell-off reflected fears of an escalating US-China trade war that could destabilize global markets.

However, markets rebounded over the weekend when Trump appeared to backtrack, stating: “it will all be fine… The USA wants to help China, not hurt it.” Bitcoin recovered from $103,000 to around $112,000 by Tuesday.

“Over $19 billion of perpetual futures crypto positions were liquidated across centralised exchanges and decentralised market places, the largest ever one-day liquidation in crypto history,” Simon Peters, a crypto analyst at the online trading platform eToro, wrote in a research note on Monday.

Analyst Perspectives

Simon Peters noted that with “this glimmer of light that Trump may not follow through with the tariff increases on China, crypto markets are on their way to recovering Friday’s losses.”

Shawn Young, chief market analyst at MEXC, described the event as a “wake-up call” for traders, calling it the ‘Great Reset’. He warned the relief rally remains vulnerable to presidential whims.

“Cooling trade frictions between the U.S and China have been a key catalyst in stabilizing global risk sentiment,” Mr Young told The Independent.

“The market is digesting the lower probability of an extended trade war and seeing Trump’s actions as a move to foster negotiations. However, until a counter announcement is made regarding the reversal of the planned tariff increase on Chinese imports, further escalations can not be ruled out.”

Historical Precedent

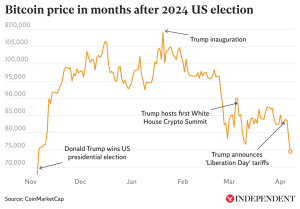

This isn’t the first time Trump’s comments have moved crypto markets significantly. During his 2024 campaign, he billed himself as the “crypto president” and promised to establish a bitcoin treasury and protect the industry from regulation.

Bitcoin hit record highs after his January inauguration but declined in subsequent months. The market’s extreme reaction highlights cryptocurrency’s sensitivity to geopolitical events and regulatory uncertainty.