Key Takeaways

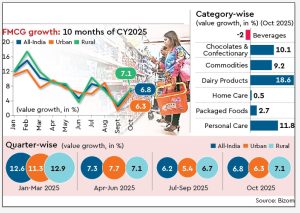

- FMCG value growth accelerated to 6.8% in October 2025 from 6.2% in previous quarter

- Urban growth rebounded to 6.3% while rural growth remained strong at 7.1%

- Dairy products led with 18.6% growth, while beverages declined due to unseasonal rains

- GST 2.0 reforms driving faster-than-expected market recovery

India’s FMCG sector has staged a strong recovery in October 2025, with value growth climbing to 6.8% as GST reforms boost consumer affordability and market sentiment.

Urban Markets Lead Recovery

According to retail intelligence platform Bizom, urban growth revived significantly to 6.3% in October compared to 5.4% in the September quarter. Rural growth remained robust at 7.1%, narrowing the urban-rural growth gap.

Harshit Bora, Analytics Head at Bizom, attributed the urban revival to GST cuts making products more affordable. “The gap between urban and rural growth is decreasing, which is visible in October,” Bora said.

Category Performance Highlights

Several categories showed impressive growth in October:

- Dairy products: 18.6% year-on-year growth

- Personal care: 11.8% growth

- Chocolates & confectionary: 10.1% growth

- Branded commodities: 9.2% growth

However, beverages declined 2% due to unseasonal rains, while home care remained flat and packaged foods grew modestly at 2.7%.

Industry Leaders Bullish on GST Impact

Marico’s MD & CEO Saugata Gupta described the GST reduction as “transformational” for the FMCG sector. “We are far more optimistic about the sector now than we were earlier. With the GST cuts, products have become affordable to consumers,” Gupta stated.

Industry executives note a significant shift from unbranded to branded consumption, particularly in food categories. Angshu Mallick of AWL Agri Business observed increased consumption of branded pulses and commodities following GST rate rationalization.

Accelerated Recovery Timeline

While most FMCG companies expected the GST benefits to materialize in November, Bizom data shows the impact became visible in October itself. This indicates the speed with which GST 2.0 reforms are driving growth in the domestic market.

Companies are now planning to increase direct distribution networks and boost spending on brand-building and innovation to capitalize on the emerging market momentum.