Global financial markets have been experiencing heightened volatility amid geopolitical tensions, shifting trade and tariff policies, central bank actions, persistent inflation concerns, currency and commodity price swings, and most recently, AI-led disruption.

Amid this market setup, the timeless quote by the English economist John Keynes feels more relevant than ever, where price action appears disconnected from traditional fundamentals.

Keynes’ observation is a cautionary reminder that markets are not always efficient in the short term. His theory believes that human behaviour, like fear, greed, herd mentality, and narrative-building influence the prices. This is visible in the current environment — sharp rallies on marginally positive news and steep sell-offs on expectations rather than outcomes.

Moreover, extreme volatility in sectors linked to themes such as artificial intelligence, defence, and rate-sensitive financial stocks, along with the recent sharp swings in gold and silver prices, underscores the importance of Keynes’ argument.

Can logic prevail?

The biggest risk for market participants in today’s conditions is to assume that “logic” will prevail quickly. Fundamentally weak stocks can keep rising despite stretched valuations, supported by ample liquidity and positive sentiment. At the same time, fundamentally strong companies may continue to underperform simply because they are out of favour.

Thus, if investors position aggressively against prevailing trends, they risk running out of capital before the market eventually turns rational.

This is particularly relevant in derivatives and leveraged trading. When there is a sudden spike in volatility, even a correct long-term view can prove costly if timing is wrong. A trader may be right about overvaluation, but if the market continues to rally for weeks or months, margin pressures can force an exit at a loss. Here, not just conviction, but solvency becomes the defining factor.

Survival matters more than being right

Keynes’ quote also shows the importance of risk management more than prediction. It underscores that survival matters more than being right in uncertain markets. This means sizing positions conservatively, avoiding excessive leverage, respecting stop-losses, and maintaining liquidity.

It is also critical for long-term investors to balance patience with discipline — staying invested in quality assets while being prepared for prolonged phases of irrational exuberance or pessimism.

Ultimately, the quote is less about markets being “wrong” and more about human limitations. Markets do not operate on our timelines. In today’s conditions — where information travels instantly, and narratives change rapidly — irrationality can persist longer than expected. Investors who recognise this reality, and structure their strategies to endure it, are far more likely to stay solvent — and succeed — over the long run.

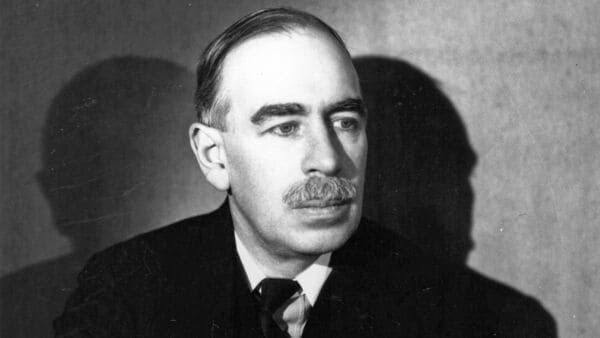

Who was John Maynard Keynes?

John Maynard Keynes was one of the most influential economists of the 20th century, born in 1883 in England. Best known as the founder of Keynesian economics and the father of modern macroeconomics, Keynes reshaped economic thinking during the Great Depression by challenging the idea that markets always self-correct.

Keynes’ seminal work – The General Theory of Employment, Interest, and Money – is considered one of the most influential economics books in history. In his book, he argued that government intervention, especially through public spending and fiscal policy, is necessary to manage economic cycles and reduce unemployment during downturns.

His ideas continue to influence central banks, policymakers, and financial markets worldwide. His writings are the basis for the school of thought known as Keynesian economics.

Disclaimer: The views and recommendations made above are those of individual analysts or broking companies, and not of Mint. We advise investors to check with certified experts before making any investment decisions.