Goldman Sachs Upgrades Paytm to ‘Buy’ with 100%+ Price Target Hike

Global brokerage giant Goldman Sachs has upgraded Paytm parent One97 Communications from ‘Neutral’ to ‘Buy’ with a massive price target increase from ₹705 to ₹1,570 – representing over 100% upside and signaling strong confidence in the fintech’s recovery.

Key Takeaways

- Goldman Sachs upgrades Paytm to ‘Buy’ with ₹1,570 price target

- Over 100% target increase signals strong recovery confidence

- Regulatory pressures easing, payments market share recovering

- 12 of 19 analysts now recommend ‘Buy’ on Paytm stock

Regulatory Environment Shows Clear Improvement

Goldman Sachs believes the regulatory challenges that previously impacted Paytm’s performance are now gradually easing. This improved environment is helping Paytm demonstrate early recovery signs in payments market share and better earnings visibility as the company relaunches key products affected by earlier regulatory actions.

The brokerage expects Paytm to maintain over 20% revenue growth as business stability returns, with regulatory headwinds turning into tailwinds.

Multiple Growth Catalysts Identified

Goldman highlighted significant additional upside potential for Paytm over the next 1-2 years, particularly if:

- Regulators take positive steps on payment charges

- Paytm continues gaining market share in core businesses

The brokerage further predicts Paytm’s EBITDA margins could more than double in the coming 3-4 years, indicating substantially stronger profitability ahead as operations scale.

Brokerage Sentiment Turns Decidedly Positive

The Goldman upgrade follows similar bullish moves by other brokerages. Last month, Axis Capital upgraded Paytm from ‘Reduce’ to ‘Buy’ with a ₹1,500 price target – currently the second-highest after Ventura Securities’ ₹2,074 target.

Analyst consensus shows growing optimism:

- 12 of 19 analysts recommend ‘Buy’

- 5 suggest ‘Hold’

- Only 2 recommend ‘Sell’

Current Stock Position and Recovery Journey

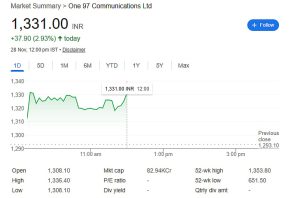

Paytm shares closed 0.51% higher at ₹1,293 on Thursday. Despite the positive developments and Goldman’s ₹1,570 target, the stock remains:

- 27% below its IPO price of ₹2,150

- 40% lower than the issue price at current levels

This indicates that while sentiment is clearly improving, Paytm still has substantial ground to cover to return to its original listing valuation, presenting both opportunity and challenge for investors.