Zerodha CEO Calls US Banking System “Broken”, Highlights UPI Advantage

Zerodha CEO Nithin Kamath has stated that the US banking system is “broken,” pointing to the substantial fees American trading platform Robinhood charges for instant withdrawals as evidence of its inefficiency compared to India’s UPI.

Key Takeaways

- Robinhood earns ~$150 million annually from instant withdrawal fees.

- Kamath contrasts this with Zerodha’s zero-fee model enabled by UPI.

- Zerodha plans to launch US stock investing via GIFT City next quarter.

Robinhood’s Revenue from Instant Withdrawals

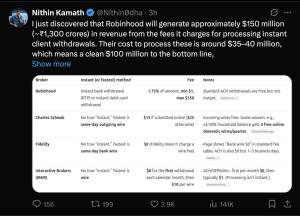

In a detailed post on X, Kamath revealed his discovery that Robinhood generates approximately $150 million (₹1,300 crores) in revenue solely from fees charged for processing instant client withdrawals. After accounting for processing costs of $35-40 million, the company nets “a clean $100 million to the bottom line, and that’s just from instant withdrawals.”

He expressed surprise at the high fee structure, which can reach 1.75% for instant withdrawals, concluding that “this really shows how broken the US banking system” is without a comprehensive instant payments network like India’s UPI.

“We don’t charge @zerodhaonline clients for deposits (thanks to UPI) or instant withdrawals.”

Zerodha’s US Investment Plans

The comments come as Zerodha prepares to enable US stock market investments for its users. During an ‘Ask Me Anything’ session, Kamath confirmed the development is underway.

“A lot of people tagged me on social media and asked about the US investing thing. We are working on it, and we should have something in the next quarter. It is a product launch.”

Zerodha CTO Kailash Nadh added that the brokerage has obtained regulatory clarity through GIFT City and is building a “simple and seamless experience for users in the backend as well as in the frontend.”