Key Takeaways

- RBI allows loans against silver jewellery and coins from April 2026

- Borrowers can pledge up to 10kg silver with varying LTV ratios

- Available through all regulated banks and financial institutions

- Silver bars, ETFs and mutual funds excluded from the scheme

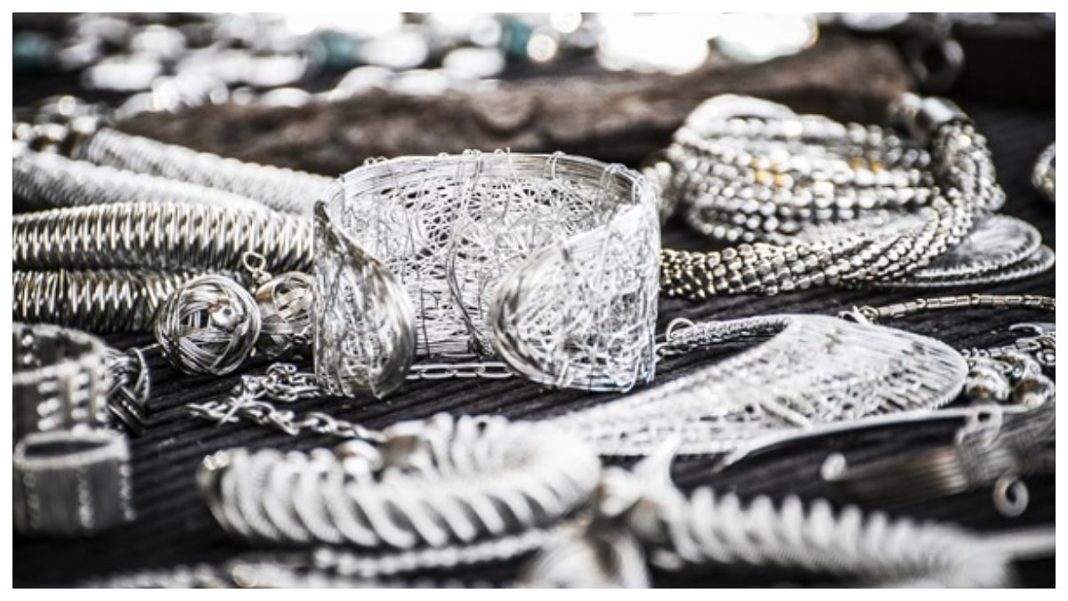

The Reserve Bank of India has introduced silver-backed loans, enabling individuals to borrow against their silver assets starting April 2026. This landmark move expands secured lending options beyond gold loans, making credit more accessible to households holding silver jewellery and coins.

RBI’s Silver Loan Policy Framework

The central bank has officially amended lending regulations to include silver ornaments and coins as acceptable collateral. Commercial banks, cooperative banks, small finance banks and other RBI-regulated lenders will offer this facility from the next financial year.

This initiative aims to enhance financial inclusion, particularly benefiting rural households and individuals who possess silver assets but may not own gold.

Eligible Silver Quantity and Types

Borrowers can pledge up to 10 kilograms of silver jewellery under the new guidelines. Additionally, silver coins up to 500 grams are acceptable as collateral.

The RBI has specifically excluded silver bricks, bars, and silver-based investment instruments like ETFs and mutual funds from the scheme. Only physical silver items in the form of jewellery and coins qualify.

Loan Amounts and LTV Ratios

- Up to 85% LTV for silver worth ₹2.5 lakh

- Up to 75% LTV for silver worth ₹5 lakh

Repayment and Recovery Terms

Lenders must return pledged silver within seven working days after full loan repayment. Failure to do so attracts a penalty of ₹5,000 per day.

In case of loan default, financial institutions reserve the right to sell the pledged silver to recover outstanding dues.

This policy represents a significant expansion of India’s secured lending landscape, providing households with additional options to leverage their precious metal assets during financial emergencies.