Key Takeaways

- OpenAI board explored merger with rival Anthropic just one day after firing Sam Altman

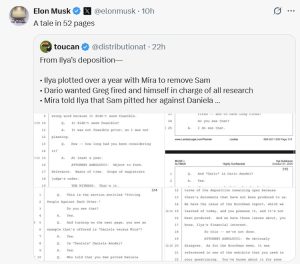

- Revelation comes from Ilya Sutskever’s deposition in Elon Musk’s lawsuit

- Merger talks failed due to practical obstacles during chaotic leadership crisis

OpenAI’s board initiated merger discussions with rival AI firm Anthropic immediately after firing CEO Sam Altman in November 2023, according to new court testimony from former chief scientist Ilya Sutskever. The revelation has reignited the public feud between Elon Musk and Sam Altman, with both tech leaders exchanging fresh accusations on social media platform X.

Board’s Secret Merger Talks

In his October 2025 deposition for Musk’s lawsuit against OpenAI, Sutskever disclosed that board member Helen Toner engaged with Anthropic on November 18, 2023 – just one day after Altman and president Greg Brockman were removed. The discussions reportedly included a proposal for Anthropic to merge with OpenAI and assume leadership control.

Sutskever testified about early conversations with Anthropic co-founders Dario and Daniela Amodei, stating he was “very unhappy” about the potential merger while Toner and other board members appeared “a lot more supportive.”

Chaotic Leadership Crisis

The merger exploration occurred during one of the most turbulent periods in OpenAI’s history. The board – consisting of Sutskever, Helen Toner, Tasha McCauley, and Adam D’Angelo – had voted to remove Altman citing “loss of confidence,” triggering immediate backlash.

Over 700 of OpenAI’s approximately 770 employees threatened to resign unless Altman was reinstated. Facing immense pressure from Microsoft and other investors, the board reversed its decision within days, restoring Altman and Brockman by November 22, 2023.

The proposed Anthropic merger was particularly notable given the company’s origins – it was founded in 2021 by the Amodei siblings after they departed OpenAI over AI safety concerns.

Sutskever, who played a key role in the initial ouster, eventually left OpenAI in May 2024. The merger talks ultimately collapsed due to what Sutskever described as “practical obstacles.”