Key Takeaways

- Nvidia acquires 2.9% stake in Nokia for $1 billion

- Nokia shares surge 21% to 10-year high after announcement

- Partnership focuses on AI-driven 5G/6G networks and data centers

- Revenue from new equipment expected from 2027

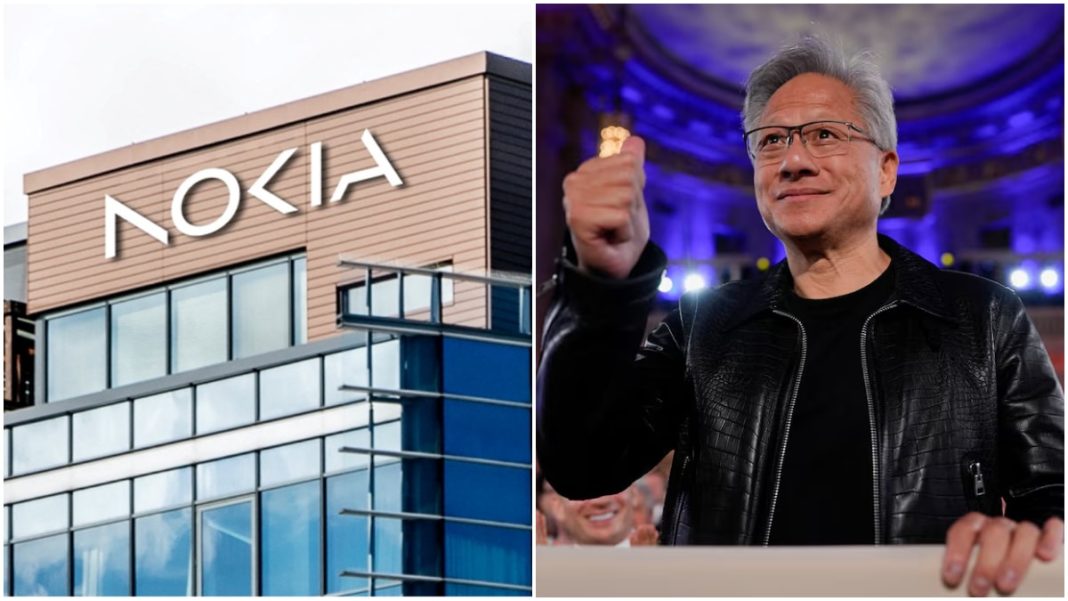

Nvidia is investing $1 billion for a 2.9% stake in Nokia, triggering a massive 21% surge in Nokia’s share price to its highest level in nearly a decade. The strategic partnership announced on Tuesday aims to develop AI-powered networking solutions and integrate Nokia’s data center technology into Nvidia’s future AI infrastructure.

Deal Structure and Share Issuance

Nokia will issue approximately 166 million new shares to Nvidia at $6.01 per share, formalizing the chipmaker’s minority ownership. Both companies confirmed these details in a joint statement.

Under the collaboration, Nvidia’s advanced chips will accelerate Nokia’s software for current 5G and future 6G networks. In return, Nvidia will explore using Nokia’s data center communication products within its own AI systems.

Strategic Importance for US Technology Leadership

Nvidia CEO Jensen Huang stated this partnership would position the United States to lead the upcoming 6G technology revolution. During a Washington address, he credited Nokia CEO Justin Hotard for helping bring advanced telecom technology back to America.

Hotard emphasized that the deal uniquely combines American innovation with Nvidia’s high-performance computing systems, now being optimized for mobile applications. He confirmed that new equipment developed through this partnership should begin generating revenue from 2027, starting with 5G applications before expanding to 6G.

Industry analyst Paolo Pescatore of PP Foresight called the agreement a strong vote of confidence in Nokia’s capabilities, noting that future 6G networks will be crucial for enabling new AI-driven experiences.

Nokia’s AI Data Center Transformation

Nokia, traditionally known for mobile network equipment, has been successfully pivoting toward data centers to capitalize on the AI-driven computing boom. This strategic shift helped the company exceed Wall Street expectations last quarter.

The Finland-based firm strengthened its position earlier this year by acquiring US company Infinera Corp. for $2.3 billion, expanding its portfolio of networking products for AI data centers.

Some market observers have drawn comparisons between Nvidia’s recent partnership patterns and the circular deals prevalent before the 1990s dot-com crash, where companies boosted growth through inter-company sales.

Once dominant in mobile phones during the 1990s, Nokia faded from consumer prominence after losing handset market leadership. Under CEO Justin Hotard’s leadership, the company is now repositioning as the only major Western alternative to Huawei, offering comprehensive communication solutions from 5G equipment to fiber optics.