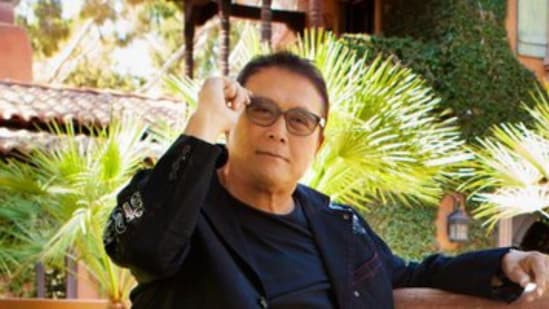

Even as he described the cryptocurrency as “crashing,” Robert Kiyosaki revealed on Saturday that he had purchased another full Bitcoin for $67,000, saying that he sees the digital asset as a shield against a weakening US dollar and a bet on its limited supply.

Kiyosaki buys bitcoin amid ‘crash’ talk

In a post on X, Kiyosaki said his latest Bitcoin buy was linked to two major factors. First, he believes a debt-driven slide in the US dollar could lead to massive money printing. Second, he noted that the Bitcoin network is moving closer to the “21 millionth Bitcoin” being mined.

In the same post, he criticized the Federal Reserve, calling it “The Marxist Fed” and described potential future money creation as “fake dollars.”

Even with sharp market ups and downs, Kiyosaki has said he keeps buying both Bitcoin and Ethereum and does not base his decisions on daily price moves.

Betting on hard assets over traditional finance

Kiyosaki has long expressed distrust toward institutions like the Federal Reserve and the US Treasury. He believes the people running these systems misunderstand money and the economy.

Alongside digital assets, he also invests in physical gold and silver. He views precious metals as traditional forms of money and positions Bitcoin as a digital alternative of those long standing stores of value.

Last year, he predicted that Bitcoin could reach $250,000 by 2026. He also set price targets of $27,000 for gold and $100 for silver, showing his belief that these assets will gain value during economic uncertainty.

A $1 million Bitcoin call

In earlier comments, Kiyosaki said he believes Bitcoin could reach $1 million over the next several years to a decade. He connects this prediction to rising U.S. national debt and what he views as the dollar losing its purchasing power.

In his Saturday post, he also said Bitcoin would outperform gold once the 21 million coin limit is reached, once again pointing to its fixed supply as the key reason.

“When the 21st millionth Bitcoin is mined…. Bitcoin becomes better than gold.” he wrote.

Scarcity drives his strategy

Kiyosaki believes Bitcoin’s fixed limit of 21 million coins is a major reason for its long-term value. He sees this built in scarcity as what could make Bitcoin more appealing than traditional safe-haven assets.

His investment approach focuses on owning limited-supply assets. Along with Bitcoin and Ethereum, he also holds physical gold and silver. At the heart of his strategy is one main worry, rising US debt and concerns about how the country’s financial system is being managed.