Union Budget 2026: Middle Class Awaits Tax Relief on February 1

All eyes are on the Union Budget 2026, to be presented on February 1, 2027, as the middle class hopes for fresh income tax relief. With the new tax regime now the default, the upcoming budget could bring key changes to slabs, deductions, or exemptions to ease the burden on taxpayers.

Key Tax Details for FY 2025-26

Understanding the current structure is crucial to gauge potential changes.

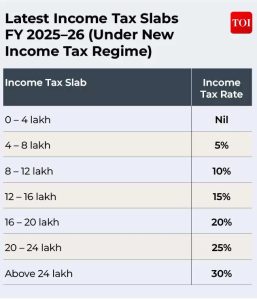

New Tax Regime (Default)

- Income up to ₹3 lakh: Exempt.

- ₹3-7 lakh: 5% tax.

- ₹7-12 lakh: 10% tax.

- ₹12-16 lakh: 15% tax.

- ₹16-20 lakh: 20% tax.

- Above ₹20 lakh: 30% tax.

- Standard deduction: ₹75,000. No other deductions allowed.

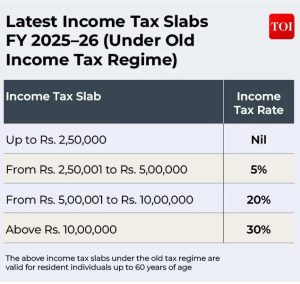

Old Tax Regime (Opt-in)

- Income up to ₹2.5 lakh: Exempt.

- ₹2.5-5 lakh: 5% tax.

- ₹5-10 lakh: 20% tax.

- Above ₹10 lakh: 30% tax.

- Allows deductions under , 80D, HRA, and home loan interest, benefiting those with high investments.

What to Expect from Budget 2026

The government may tweak the new regime to make it more attractive, possibly by adjusting income slabs or raising the standard deduction. Alternatively, it could enhance deduction limits under the old regime to reward savers. The final choice between regimes hinges entirely on individual financial profiles.

Expert advice: Taxpayers should calculate their liability under both systems for the current financial year to identify the most beneficial option.