Key Takeaways

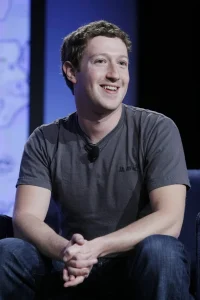

- Meta directors including Mark Zuckerberg agree to $190 million settlement

- Lawsuit alleged board failures in Cambridge Analytica privacy scandal

- Settlement includes governance reforms for privacy oversight

- Payment comes from insurance, not executives’ personal funds

Meta’s directors, including CEO Mark Zuckerberg, have agreed to a $190 million settlement to resolve a shareholder lawsuit stemming from the Cambridge Analytica data privacy scandal. The legal action alleged that board members failed to prevent repeated privacy violations that exposed the company to massive regulatory penalties.

The settlement, one of the largest derivative recoveries in Delaware court history, also mandates significant governance changes at Meta. These reforms aim to strengthen privacy oversight and enhance whistleblower protections for employees.

Settlement Details and Court Approval

The $190 million payment will be covered by directors’ and officers’ liability insurance rather than coming from executives’ personal funds. This resolves a trial that began in July, where plaintiffs had initially sought approximately $8 billion in damages.

Delaware Chancery Court Judge Kathaleen SJ McCormick must still approve the proposed agreement. The settlement effectively shortened what was scheduled to be an eight-day trial.

Governance Reforms and Legal Context

As part of the agreement, Meta’s board will adopt governance reforms focused on improving privacy oversight and protecting whistleblowers. Shareholder lawyers had accused the board of permitting policies that exposed Meta to substantial regulatory fines, including the record $5 billion Federal Trade Commission penalty related to Facebook’s data practices.

The plaintiffs’ legal team has indicated they will seek fees of up to 30% of the settlement amount plus expenses, to be paid from the settlement proceeds. Pension funds and institutional investors that led the lawsuit described the deal as an important step for board accountability.

Broader Implications for Tech Sector

This settlement underscores growing judicial scrutiny of director oversight responsibilities in the technology sector. The case has sparked wider discussions about corporate governance standards and the role of Delaware courts in overseeing major corporate legal matters.

The court will now review the settlement documents and determine whether to approve both the deal and the requested legal fees. The outcome could influence how similar cases are handled in the future and may fuel ongoing debates about corporate governance reform.