Key Takeaways

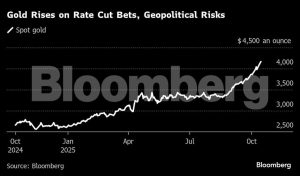

- Gold hits record high of $4,185/oz on Fed rate cut signals and US-China tensions

- Silver sees extreme volatility, hitting $53.54/oz before retreating as London squeeze eases

- US Treasury yields drop to multi-week lows after Powell’s dovish comments

- Traders await Section 232 probe results that could impact silver, platinum, and palladium

Gold prices surged to a fresh all-time high, driven by Federal Reserve rate cut expectations and escalating US-China trade tensions. The precious metal reached $4,185 per ounce as investors sought safe-haven assets amid market uncertainty.

Spot silver experienced dramatic swings, climbing to a record $53.54 per ounce before pulling back. The volatility reflected a historic squeeze in London markets that’s now showing signs of easing, though borrowing costs remain elevated.

Fed Policy Drives Metals Rally

Federal Reserve Chair Jerome Powell signaled additional rate cuts are forthcoming, pushing Treasury yields to their lowest levels in weeks. Lower interest rates typically benefit precious metals since they don’t offer yield, making them more attractive when borrowing costs decline.

The Fed’s dovish stance has supported gold’s 58-80% rally across the four main precious metals this year. Central bank purchases and growing ETF holdings have further underpinned the bullion’s advance.

Geopolitical Tensions Boost Haven Demand

Risk-off sentiment swept through markets after President Donald Trump threatened to halt cooking oil trade with China. The comments reignited trade tensions between the world’s largest economies, with Beijing promising retaliation following recent US tariff threats.

Recurring US-China disputes, concerns about Fed independence, and government shutdown fears have all contributed to the ‘debasement trade’ – where investors use precious metals to hedge against currency devaluation from expanding budget deficits.

Silver Market Normalization

The silver market’s extreme conditions showed modest improvement as the gap between London and New York prices narrowed. However, traders remain cautious ahead of the US administration’s Section 232 investigation into critical minerals, which includes silver, platinum, and palladium.

The probe has raised concerns about potential new tariffs, despite these metals receiving official exemptions in April.

At 9:16 a.m. in Singapore, spot gold traded 0.9% higher at $4,180.83 an ounce. The Bloomberg Dollar Spot Index edged lower while silver, platinum, and palladium all gained more than 1%.