Key Takeaways

- Nvidia’s Wednesday earnings report will test whether the AI boom is sustainable or a bubble

- The chipmaker’s market value has fallen 10% after hitting $5 trillion, raising investor concerns

- Analysts expect $54.9 billion revenue, a 59% year-over-year increase

- CEO Jensen Huang’s commentary will be closely watched for AI market outlook

All eyes are on Nvidia as the chipmaker prepares to release quarterly earnings that could either calm recent market jitters or confirm fears of an AI bubble. The world’s most valuable company faces its biggest test yet amid growing skepticism about artificial intelligence investments.

The AI Barometer

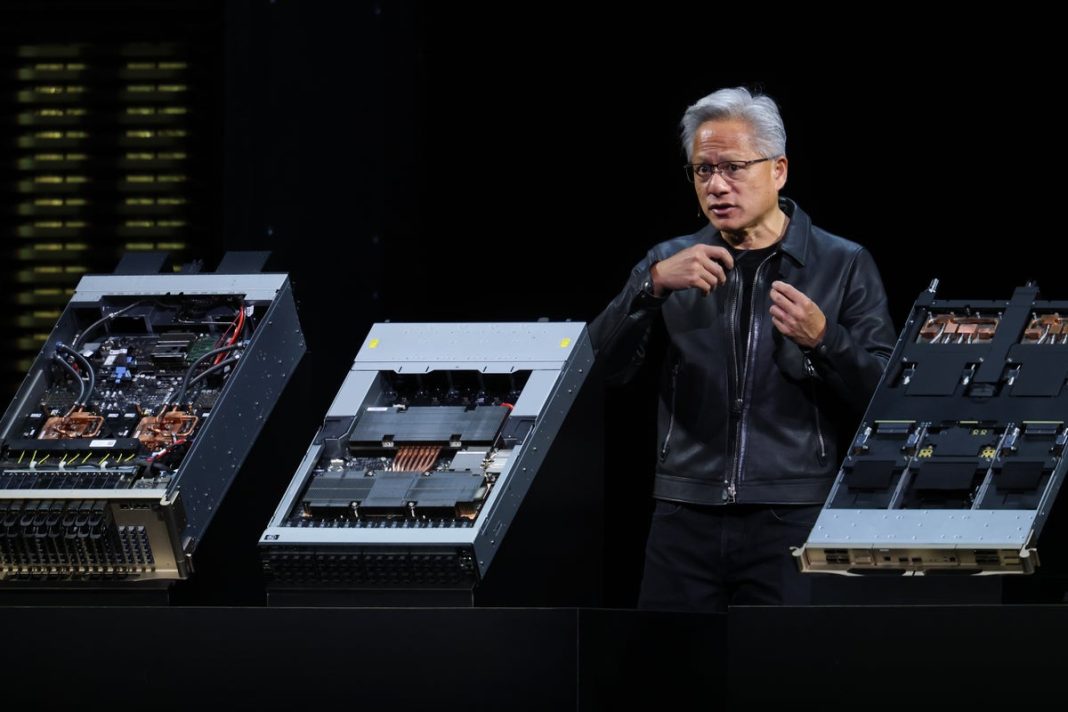

Wednesday’s earnings report after market close serves as a crucial barometer for the AI boom that began with ChatGPT’s launch three years ago. Nvidia transformed from a gaming graphics chip manufacturer to the leading AI indicator, with its specialized chipsets now powering the technology revolution.

As OpenAI and tech giants including Microsoft, Google, Amazon and Meta Platforms buy more Nvidia chips, annual revenue surged from $27 billion in 2022 to a projected $208 billion this year. This explosive growth fueled a 10-fold increase in market value to $4.5 trillion, surpassing Apple, Microsoft and Alphabet.

“Saying this is the most important stock in the world is an understatement,” said Jay Woods, chief market strategist of Freedom Capital Markets.

Rising Skepticism and Market Correction

Despite Nvidia’s history of beating analyst projections and CEO Jensen Huang’s bullish outlook about decade-long growth, investor skepticism is mounting. The company’s market value dropped over 10% just three weeks after becoming the first $5 trillion company.

“Skepticism is the highest now than anytime over the last few years,” said Nancy Tengler, CEO of Laffer Tengler Investments.

High Expectations and Huang’s Guidance

Nvidia is expected to report $1.26 per share on $54.9 billion revenue, representing 59% year-over-year growth. However, the bar is set exceptionally high – the company needs to deliver even stronger performance to ease bubble concerns.

Investors will closely parse Huang’s remarks about past quarter performance and current market conditions, treating his assessment as the AI industry’s State of the Union address. The outcome will determine whether Nvidia can maintain its dominant position in the or face increased pressure from competitors.