Govt Plans Hybrid ATMs for Small Notes Amid UPI Boom

The Indian government is planning to introduce hybrid ATMs specifically designed to dispense small-denomination notes. This move aims to ensure cash availability for daily transactions even as digital payments like UPI see explosive growth.

Key Takeaways

- New hybrid ATMs will dispense ₹10, ₹20, ₹50, and ₹100 notes.

- Machines to be placed in high-footfall areas like markets and transport hubs.

- Plan follows a decline in the value share of small notes in circulation.

- Government is pursuing a public-private partnership (PPP) model for rollout.

Addressing the Cash-Digital Balance

An official, requesting anonymity, stated the core objective: “The idea is to ensure that people have access to small denomination notes for daily needs. While UPI has seen phenomenal growth, cash remains important for small transactions, especially in rural and semi-urban areas.”

The hybrid ATMs will be deployed in busy locations such as markets, bus stands, railway stations, and hospitals. This is intended to reduce the burden on bank branches for providing change.

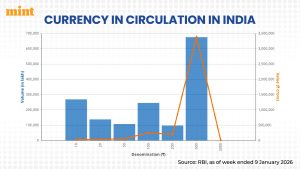

Declining Share of Small Notes

The initiative comes as the value share of small notes (₹10 to ₹100) in total currency circulation has fallen sharply. RBI data shows it dropped to 12.4% in FY24 from 21.6% in FY17.

However, in volume terms, these notes still made up 86.4% of all notes in circulation in FY24, highlighting their high usage but low individual value.

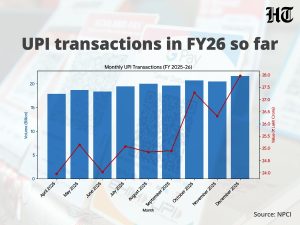

UPI Growth and the Need for Cash

This push for cash access runs parallel to the staggering growth of UPI. In the first nine months of FY26, UPI transaction volume hit 130.5 billion, a 42% year-on-year increase.

“The government wants to ensure that the push for digital payments does not lead to a shortage of cash, especially small notes, for those who need it,” the first official explained.

Operational Efficiency and RBI’s Stance

The hybrid ATMs are also expected to cut banks’ operational costs, as dispensing small notes via regular ATMs is often not cost-effective. The machines may also feature cash deposit functions.

The plan aligns with the RBI’s commitment to ensuring adequate availability of all note denominations. The central bank has stated it is “closely monitoring the situation” to prevent any shortages.

Next Steps and Scale

The hybrid ATMs will supplement India’s existing network of over 208,000 ATMs. The proposal was discussed in a recent finance ministry meeting with banks and manufacturers.

A second official noted, “The response from banks and ATM manufacturers has been positive. We expect to finalise the plan in the next few months.” The model under discussion is a 24×7 public-private partnership.