Budget 2026: India May Adopt GST-Style Fewer Tax Slabs in New Income Tax Regime

Key Takeaways

- The government is considering reducing the new tax regime’s slabs from six to three or four by 2026.

- The move aims to simplify filing, boost compliance, and eventually phase out the old regime.

- Changes are likely to be gradual, starting with groundwork in the 2025 budget.

The Indian government is planning a major simplification of the income tax system, aiming to introduce fewer tax slabs under the new regime by Budget 2026. Inspired by the GST model, this overhaul seeks to make tax filing easier and shift taxpayers towards the new, deduction-light structure.

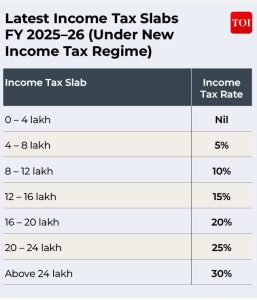

Proposed New Tax Slab Structure

Currently, the new tax regime has six slabs with rates from 0% to 30%. The proposal is to consolidate these into three or four. One model under discussion includes:

- 0% tax for income up to ₹5 lakh annually.

- 10% rate for income between ₹5 lakh and ₹10 lakh.

- 20% rate for income above ₹10 lakh, with a possible top tier for very high incomes.

Rationale and GST Inspiration

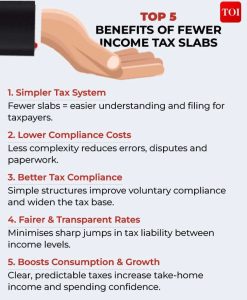

The goal is to boost compliance, reduce litigation, and simplify calculations for taxpayers. Officials see the four-slab GST structure as a successful template for a simpler system.

Phased Implementation Roadmap

Officials indicate any radical change will be gradual. The 2025 budget may lay the groundwork for a transition to be completed by Budget 2026. The focus is on making the new regime—with lower rates but fewer deductions—the default and more appealing choice.

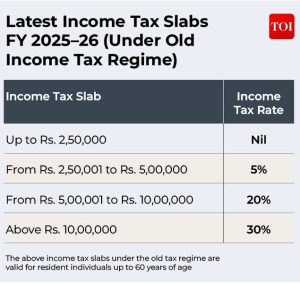

The old regime, which allows deductions under sections like and but has higher rates, may be phased out once the new system is streamlined and accepted.

Expected Benefits and Challenges

Key benefits include reduced filing complexity, lower administrative costs, and potentially higher disposable income for some brackets, stimulating consumption. However, the government must ensure the change is revenue-neutral, balancing simplification with a broad enough tax base.

Finance ministry teams are studying international models and running revenue simulations. The final structure will aim to be progressive yet simpler than the current system.

Expert View and the Road Ahead

Tax experts suggest the government may need to further limit or standardize deductions in the new regime to prevent revenue shortfalls. The upcoming budgets will be closely watched for signals on this proposed roadmap to a GST-like income tax structure.