Key Takeaways

- Nvidia reported sales and profits up over 60% year-on-year, beating Wall Street forecasts

- Company projects $65 billion Q4 revenue and sees $3-4 trillion annual AI infrastructure spending by 2030

- Despite strong results, NVDA stock dipped 1% as bubble concerns persist

- Analysts remain divided on whether AI represents a sustainable revolution or potential bubble

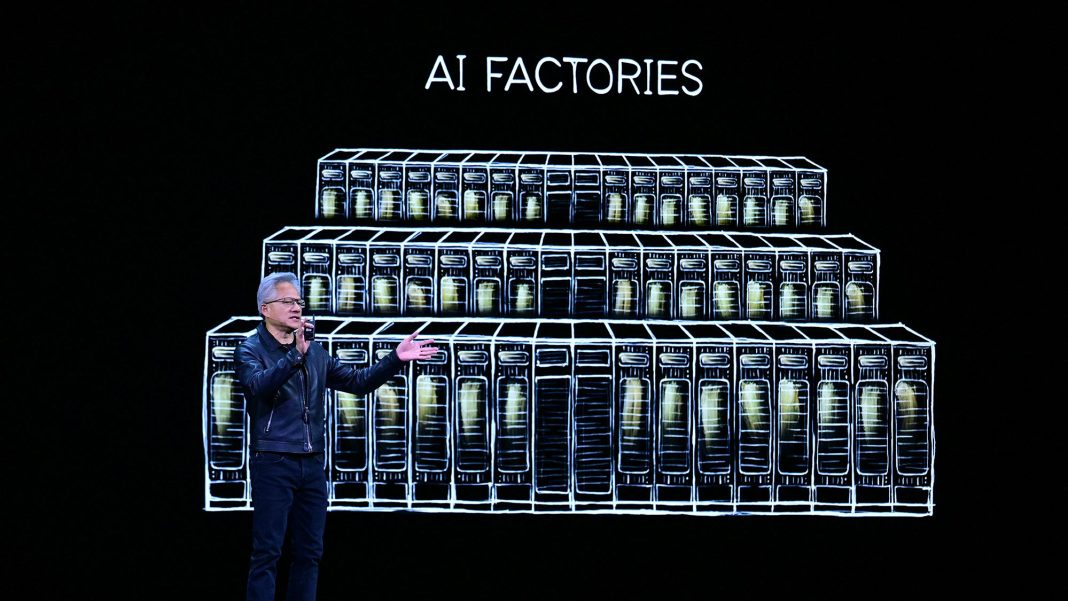

Nvidia’s blockbuster earnings report delivered overwhelming growth numbers, but failed to completely ease investor concerns about an AI bubble. The chip giant posted sales and profits surging more than 60% year-on-year, with CEO Jensen Huang declaring “sales are off the charts.”

The company expects fourth-quarter revenue around $65 billion, again surpassing Wall Street projections. Nvidia executives pointed to these results as evidence that AI bubble fears are exaggerated.

Strong Fundamentals Despite Market Skepticism

Nvidia CFO Colette Kress revealed the company anticipates $3 trillion to $4 trillion in annual AI infrastructure spending by decade’s end, noting demand “continues to exceed our expectations.” Tech giants are projected to invest $400 billion in AI capital expenditures this year alone.

“There’s been a lot of talk about an AI bubble,” Huang told analysts. “From our vantage point, we see something very different.”

Despite the optimistic outlook, NVDA shares closed Friday down 1%, though the stock remains up 29% year-to-date. The market reaction suggests investors need more convincing about AI’s long-term sustainability.

Industry Validation and Broader Applications

Kress highlighted success stories from Nvidia partners: Meta’s AI systems increase user engagement, Anthropic projects $7 billion annual revenue, and Salesforce reports 30% engineering efficiency gains from AI coding tools.

Huang emphasized Nvidia’s role extends beyond generative AI to existing cloud infrastructure. “The world has a massive investment in non-AI software… representing hundreds of billions in cloud computing spend,” much now transitioning to Nvidia GPUs.

Wedbush analyst Dan Ives commented: “The pure Nvidia numbers show the AI Revolution is NOT a Bubble… it’s Year 3 of a 10-year build out.” Morningstar’s Brian Colello sees current bubble fears as a “buying opportunity” for Nvidia stock.

Persistent Concerns and Sustainability Questions

Questions linger about Big Tech’s massive AI spending, particularly around Nvidia’s investments in unprofitable partners like OpenAI and Anthropic.

OpenAI CFO Sarah Friar recently suggested government backing for AI infrastructure debt, raising concerns about affordability. Though walked back, the comments highlighted financial pressures.

Synovus Trust’s Daniel Morgan noted sustainability questions about infrastructure spending and circular funding deals weren’t “put to rest” by Nvidia’s report, merely “punted to the next quarter.”

Nvidia faces continued work convincing markets we’re witnessing an AI boom rather than an impending bust, despite delivering exceptional financial performance.