Excelsoft Technologies IPO Sees Strong First-Day Response

The ₹500-crore initial public offering (IPO) of Excelsoft Technologies received an impressive 1.45 times subscription on its opening day, signaling robust investor interest in the education technology company.

Key Subscription Details

- Overall Subscription: 1.45 times on Day 1

- Non-Institutional Investors: 2.45 times subscription

- Retail Investors (RIIs): 1.85 times subscription

- Qualified Institutional Buyers (QIBs): 1% subscription

The three-day IPO attracted bids for 4.45 crore shares against 3.07 crore shares available, according to NSE data. The bidding will conclude on November 21.

IPO Structure and Pricing

The IPO comprises a fresh issue of up to ₹180 crore and an offer for sale of up to ₹320 crore. The price band has been fixed at ₹114-120 per share, valuing the company at approximately ₹1,380 crore at the upper end.

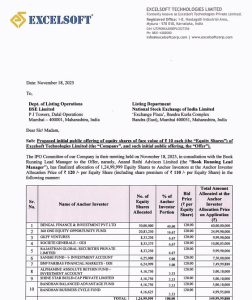

Prior to the IPO opening, Excelsoft secured ₹150 crore from anchor investors on Tuesday, demonstrating institutional confidence in the company’s prospects.

Fund Utilization Plan

The company plans to allocate the fresh issue proceeds strategically:

- ₹61.76 crore for land purchase and construction of new building in Mysore

- ₹39.51 crore for upgrading existing Mysore facility’s electrical systems

- ₹54.63 crore for IT infrastructure enhancement

- Remaining funds for general corporate purposes

Company Background

With over two decades of experience, Excelsoft Technologies is a vertical SaaS company specializing in learning and assessment solutions. The company serves global enterprise clients through long-term contracts across diverse education segments.

Excelsoft’s client portfolio includes prominent names such as Pearson Education, AQA Education, Colleges of Excellence, Ascend Learning LLC, Brigham Young University, and Training Qualifications UK, among others.