Key Takeaways

- Nvidia smashed Q3 earnings with $57B revenue (62% growth) and $31.9B profit

- Strong Q4 guidance of $65B signals continued AI spending boom

- Stock jumped 3.4% after hours, boosting broader tech market

Nvidia delivered blockbuster quarterly results that surpassed Wall Street forecasts, easing concerns about an AI bubble. The chipmaker’s stellar performance sent its stock soaring and lifted other major tech companies in after-hours trading.

Record-Breaking Quarter Defies Bubble Fears

Nvidia reported $57 billion in revenue for the October quarter, beating the $54.9 billion projection with 62% year-over-year growth. Profits reached $31.9 billion, up 65% from the same period last year.

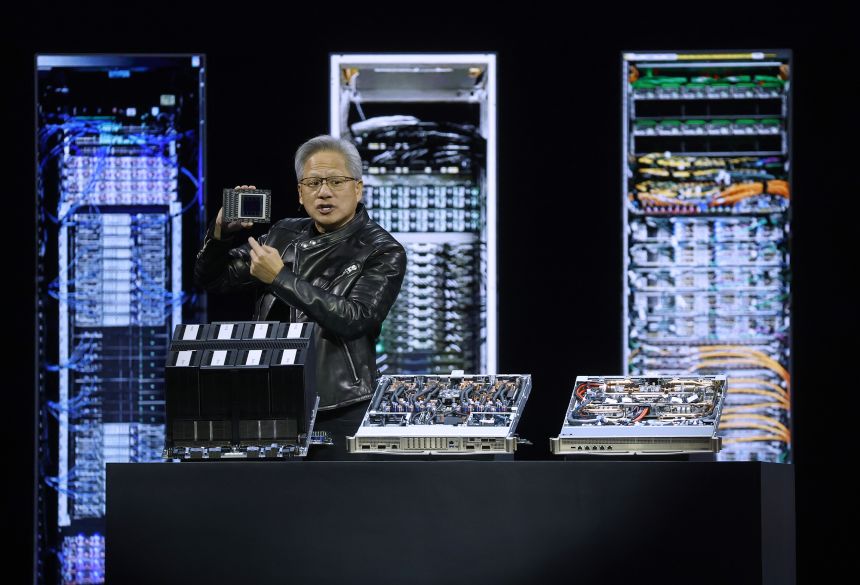

“Blackwell sales are off the charts, and cloud GPUs are sold out,” Nvidia CEO Jensen Huang said in a statement, a message that echoes his earlier arguments that fears of an AI bubble are overblown.

The company’s optimistic Q4 guidance of approximately $65 billion further reinforced that AI infrastructure spending shows no signs of slowing.

Market Impact and Ripple Effects

Nvidia’s stock (NVDA) surged 3.4% immediately after the earnings release. As the world’s most valuable public company accounting for roughly 8% of the S&P 500, Nvidia’s performance significantly influences broader market sentiment .

Shares of Meta, Microsoft, Amazon, and Google all climbed in after-hours trading following Nvidia’s report, demonstrating the chipmaker’s pivotal role in the tech ecosystem.

“This answers a lot of questions about the state of the AI revolution, and the verdict is simple: it is nowhere near its peak, neither from the market-demand nor the production–supply-chain sides for the foreseeable future,” Thomas Monteiro, senior analyst at Investing.com, said in emailed commentary following the report.

Addressing Bubble Concerns

Despite ongoing worries about circular funding deals between chipmakers and AI companies, Nvidia continues to secure major partnerships. Anthropic recently committed to $30 billion in computing capacity using Nvidia chips through Microsoft Azure.

Huang has consistently dismissed bubble concerns, arguing at last month’s GTC conference that willingness to pay for AI tools proves the technology’s profitability, even as companies reinvest earnings into infrastructure.

Major tech firms have confirmed continued AI spending increases in their recent earnings, supporting Nvidia’s growth trajectory. The company plans to expand its technology into diverse sectors including telecommunications and autonomous vehicles.