Key Takeaways

- Nvidia CEO Jensen Huang reveals $500 billion in orders for 2025 and 2026

- Analysts see strong upside to current 2026 revenue forecasts

- Stock remains 5% below announcement levels as market debates AI spending

- All major tech giants are Nvidia customers, driving “insatiable AI appetite”

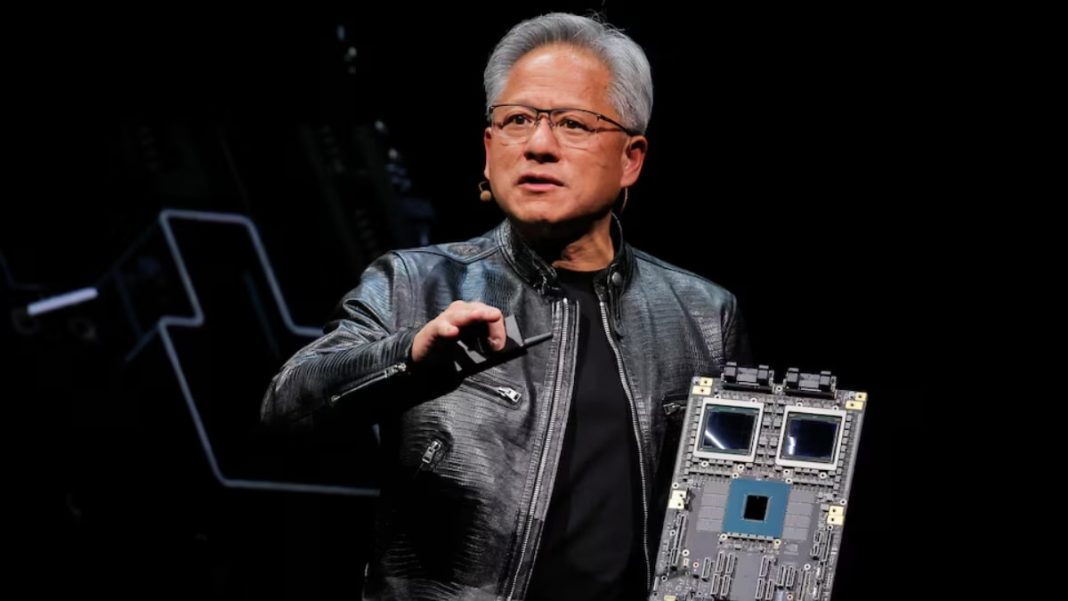

Nvidia CEO Jensen Huang has disclosed a massive $500 billion order pipeline for 2025 and 2026, signaling the AI boom has substantial room to run despite investor Peter Thiel exiting his Nvidia holdings.

“This is how much business is on the books. Half a trillion dollars’ worth so far,” Huang announced at the company’s GTC conference in Washington.

$500 Billion Order Breakdown

The staggering figure includes revenue already booked for 2025, sales of current Blackwell chips, next year’s Rubin processors, and networking equipment. Analysts see this as a strong indicator for 2026 performance.

“NVDA’s disclosures suggest clear upside to current consensus estimates,” wrote Wolfe Research analyst Chris Caso. He estimates Huang’s update could push data center revenue approximately $60 billion above Wall Street’s earlier 2026 forecasts.

Market Reaction and Quarterly Results

Despite the huge numbers, Nvidia’s stock trades about 5% below its October 28 announcement level. The market remains divided on whether hyperscalers are overspending on AI infrastructure or if demand will continue rising.

Nvidia reports third-quarter results this Wednesday, with analysts expecting $1.25 EPS on $54.83 billion revenue – a 56% year-over-year jump. January quarter projections of $61.88 billion suggest accelerating growth.

Customer Base and Strategic Investments

Huang emphasized Nvidia has “visibility” into future revenue with Google, Amazon, Microsoft, and Meta all as customers. Oppenheimer’s Rick Schafer noted hyperscalers’ spending reflects “insatiable AI appetite.”

The company has been actively expanding through strategic investments:

- Up to $10 billion in OpenAI for 4-5 million GPUs over coming years

- $5 billion in Intel for better CPU-GPU integration

- $1 billion stake in Nokia for telecom hardware integration

Competition and China Challenges

While Nvidia controls over 90% of the AI GPU market, major customers are developing custom chips. Investors await Huang’s comments on this growing competition.

China remains uncertain – the $500 billion projection excludes Chinese sales. Nvidia secured H20 chip export licenses through a deal with former President Donald Trump, but executives express doubt about major China sales. The H20 lacks a successor and is considered outdated by AI standards, though Schafer sees a potential $50+ billion annual opportunity.