Key Takeaways

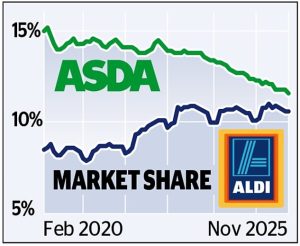

- Asda’s market share has fallen to 11.8% – its lowest since 2011

- Sales dropped 6.5% in 12 weeks to November 1, making it the worst performer

- Aldi could overtake Asda as UK’s third-largest grocer within 6-12 months

- The supermarket has been without a CEO for over four years

Asda faces an existential crisis as discount rival Aldi prepares to overtake it in the UK grocery rankings. Latest figures reveal the supermarket’s market share has plummeted to just 11.8% – its lowest level since records began in 2011.

Strategic Missteps Under Issa Brothers

The retailer’s decline accelerated under owners Mohsin and Zuber Issa, who purchased Asda in a £6.8 billion deal with TDR Capital in 2021. Controversial decisions included raising petrol prices in deprived areas like Moss Side, Manchester, while acquiring a store in affluent Hale Barns – far from Asda’s core customer base.

Analysts say the brothers loaded the business with unsustainable debt. Internal distractions followed, including press coverage of Mohsin Issa’s relationship with former EY tax partner Victoria Price. Zuber eventually sold his stake to TDR Capital, making it the majority shareholder.

Failed Turnaround Attempt

Former Asda boss Allan Leighton returned as executive chairman to revive the chain’s low-cost roots. However, one year into his leadership, the situation has worsened dramatically.

Sales fell by 6.5% in the 12 weeks to November 1 – the worst performance among major grocers. After adjusting for inflation, the volume of goods sold dropped approximately 10%. Shore Capital analyst Clive Black called the slump “remarkable,” noting “Asda’s momentum is exceptionally weak” heading into Christmas.

Aldi Overtaking Imminent

Retail expert Jonathan de Mello warned: “If current sales trajectories continue, Aldi could feasibly overtake Asda in the next six to 12 months, particularly if cost-of-living pressures persist and shoppers remain focused on value.”

The decline comes despite Asda completing its IT separation from former owner Walmart – Europe’s largest retail overhaul intended to stabilize operations.

Leadership Vacuum

The 72-year-old Leighton continues without a chief executive – a position vacant for over four years. The company approached several industry heavyweights, including former Aldi and Tesco UK boss Matthew Barnes, but all declined what’s seen as a “poisoned chalice.”

An Asda source maintained confidence in the long-term strategy, claiming the supermarket has re-established itself as Britain’s cheapest traditional grocer while improving product availability and customer experience. However, with Aldi closing in rapidly, time is running out for one of Britain’s most familiar retail brands.