Key Takeaways

- Nvidia becomes world’s first $5 trillion company, surpassing Apple and Microsoft

- CEO Jensen Huang revealed $500+ billion in chip orders through 2026

- Stock surged 14% over five days following the announcement

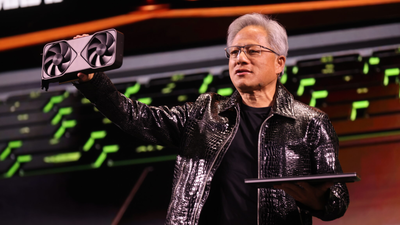

Nvidia has achieved a historic milestone by becoming the first company to reach a $5 trillion market valuation. The record-breaking achievement came after CEO Jensen Huang’s announcement at the GTC developer conference that the company has “visibility into half a trillion dollars in revenue.”

What Triggered the Rally?

During the Washington D.C. conference, Huang revealed Nvidia has secured more than $500 billion in chip orders through 2026. “I think we are probably the first technology company in history to have visibility into half a trillion dollars [in revenue],” he stated, referring to massive demand for the company’s Blackwell and upcoming Rubin chip architectures.

The remark signaled enormous demand for Nvidia’s artificial intelligence chips, sparking immediate investor optimism. Shares soared more than 14% over the past five days, with a 4% single-day push pushing the company past the $5 trillion threshold.

Rapid Growth Trajectory

Nvidia’s ascent from $1 trillion valuation in mid-2023 to $5 trillion in 2025 demonstrates extraordinary momentum. The company reached the $5 trillion mark just over three months after crossing $4 trillion, indicating accelerating AI adoption across industries.

Despite facing export control challenges in China, Nvidia continues expanding U.S. manufacturing operations. Blackwell GPU production is now in full swing in Arizona, and the company announced $1 billion in new partnerships with Nokia for 5G/6G development and Oracle for building AI supercomputers for the U.S. Department of Energy.

Market Leadership

Nvidia now ranks ahead of Microsoft ($4 trillion) and Apple ($3.9 trillion), as well as Google parent Alphabet ($3.2 trillion), Amazon ($2.4 trillion) and Meta ($1.8 trillion). The company’s dominant position in the global AI chip market appears stronger than ever, with Huang’s single statement capturing the unprecedented scale of its growth trajectory.