Key Takeaways

- US Federal Reserve cuts interest rates by 25 bps to 3.75%-4.00%

- Second consecutive rate cut following September 2025 reduction

- Quantitative tightening to end from December 1

- Decision approved with 10-2 majority amid internal dissent

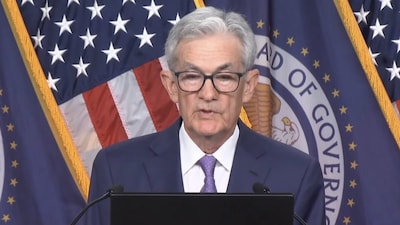

The US Federal Reserve has delivered another 25 basis point rate cut, bringing the key interest rate to 3.75%-4.00%. This marks the second consecutive reduction following September’s cut, signaling continued monetary policy easing amid economic uncertainty.

The Federal Open Market Committee approved the move with a 10-2 majority. Governor Stephen Miran argued for a steeper half-point reduction, while Kansas City Fed President Jeffrey Schmid opposed any cut.

“In support of its goals and in light of the shift in the balance of risks, the Committee decided to lower the target range for the federal funds rate by 1/4 percentage point to 3-3/4 to 4 percent,” the Federal Open Market Committee (FOMC) said in a statement on October 29.

The Committee noted elevated economic uncertainty and rising downside risks to employment. It remains attentive to dual mandate risks.

“Available indicators suggest that economic activity has been expanding at a moderate pace. Job gains have slowed this year, and the unemployment rate has edged up but remained low through August; more recent indicators are consistent with these developments. Inflation has moved up since earlier in the year and remains somewhat elevated,” the FOMC stated.

Quantitative Tightening Ends December 1

In a significant parallel move, the Fed will halt its balance sheet reduction program from December 1. The post-meeting statement provided no clear guidance about December’s policy direction.

The next Fed meeting is scheduled for December 9-10, with the decision announcement on December 10. According to September’s ‘dot plot’, officials anticipated two more cuts this year.

Economic Context and Inflation

The Fed had reduced rates three times in 2024 before pausing to assess the impact of President Donald Trump’s tariffs. Rates remained unchanged at 4.25%-4.50% for five consecutive reviews until July 2025.

Current US CPI inflation stands at 3%, below most analyst expectations. The Fed maintains its 2% inflation target.

Impact on Indian Markets

Despite the rate cut, Nifty futures (GIFT Nifty) indicate a gap-down opening, trading nearly 90 points lower at 26,166. The Fed decision is generally positive for Indian export-oriented sectors including IT and pharma.